Finding Dollar Duration

Quantitative Finance

Level

3

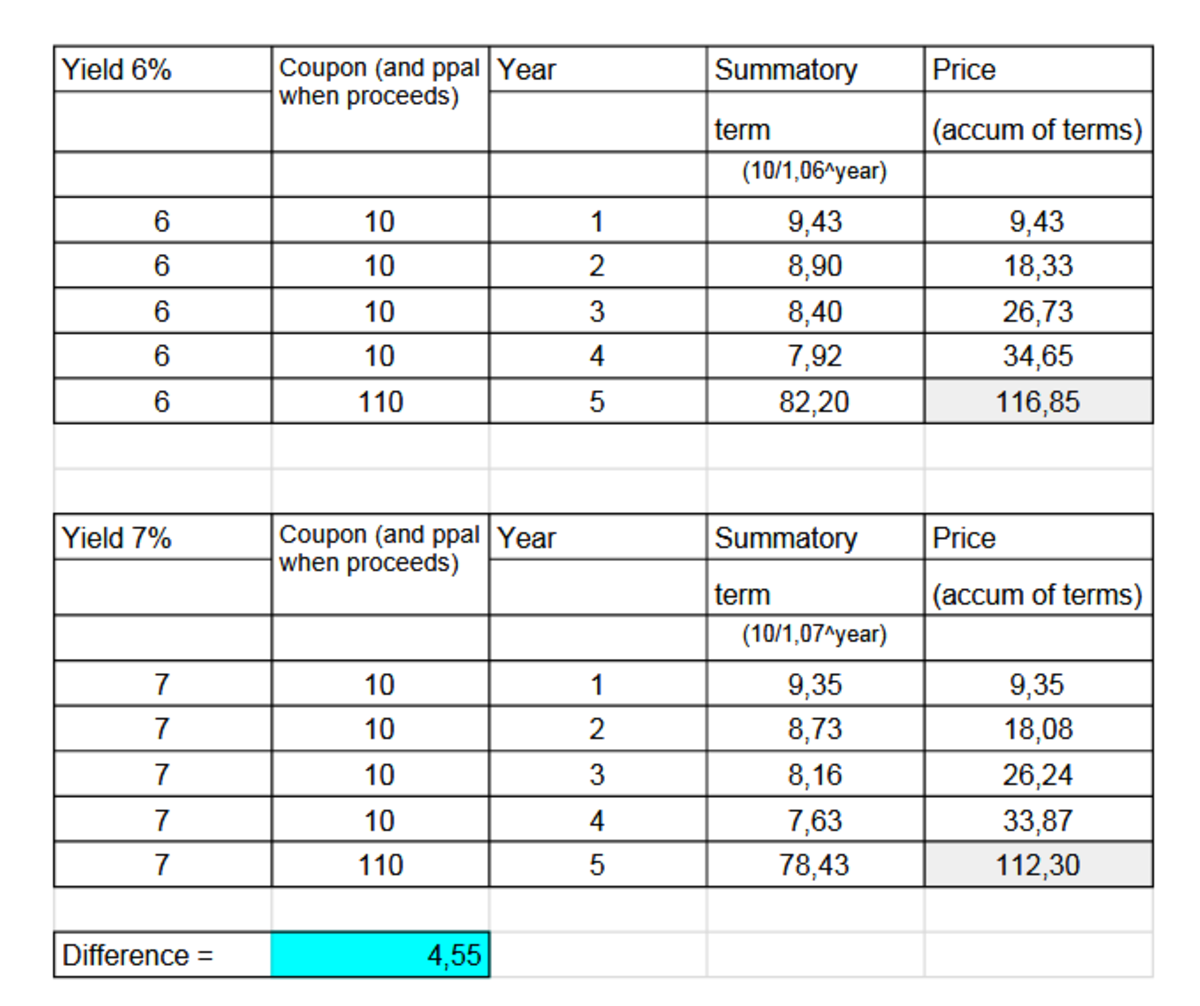

What is the (dollar) price change for a 1% increase in yield (in $) of a $100 bond that pays 10% coupon rate for 5 years, with a constant yield curve of 6%?

The answer is 4.55.

This section requires Javascript.

You are seeing this because something didn't load right. We suggest you, (a) try

refreshing the page, (b) enabling javascript if it is disabled on your browser and,

finally, (c)

loading the

non-javascript version of this page

. We're sorry about the hassle.

At 6% = $116.84 At 7% = $112.30

116.84 - 112.30 = $4.54

You simply find the value of the bond using the discount rate of 6%, Annual Payment of $10, Fair value of $100 and N of 5 Years. Then calculate again with same numbers but change the 6% to 7%.