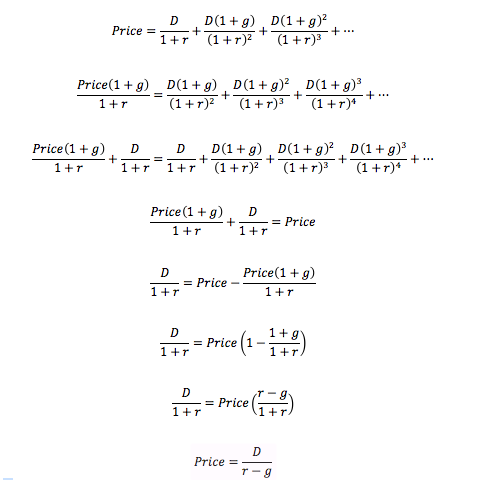

Dividend cash flow

You want to value stock dividends that are projected to grow forever at a constant rate

, using a discount rate of

. If the dividend in the first period is

, what is the value of this cash flow?

You want to value stock dividends that are projected to grow forever at a constant rate

, using a discount rate of

. If the dividend in the first period is

, what is the value of this cash flow?

Assume that .

Image credit: Wikipedia Statetrustgroupllc

This section requires Javascript.

You are seeing this because something didn't load right. We suggest you, (a) try

refreshing the page, (b) enabling javascript if it is disabled on your browser and,

finally, (c)

loading the

non-javascript version of this page

. We're sorry about the hassle.