Futures and Options market and arbitrage profits

Near market closing time on a given day, you lose access to stock prices, but some European call and put prices for a stock are available as follows:

| Strike Price | Call Price | Put Price |

| $40 | $11 | $3 |

| $50 | $6 | $8 |

| $55 | $3 | $11 |

All six options have the same expiration date. After reviewing the information above, X tells Y and Z that no arbitrage opportunities can arise from these prices.

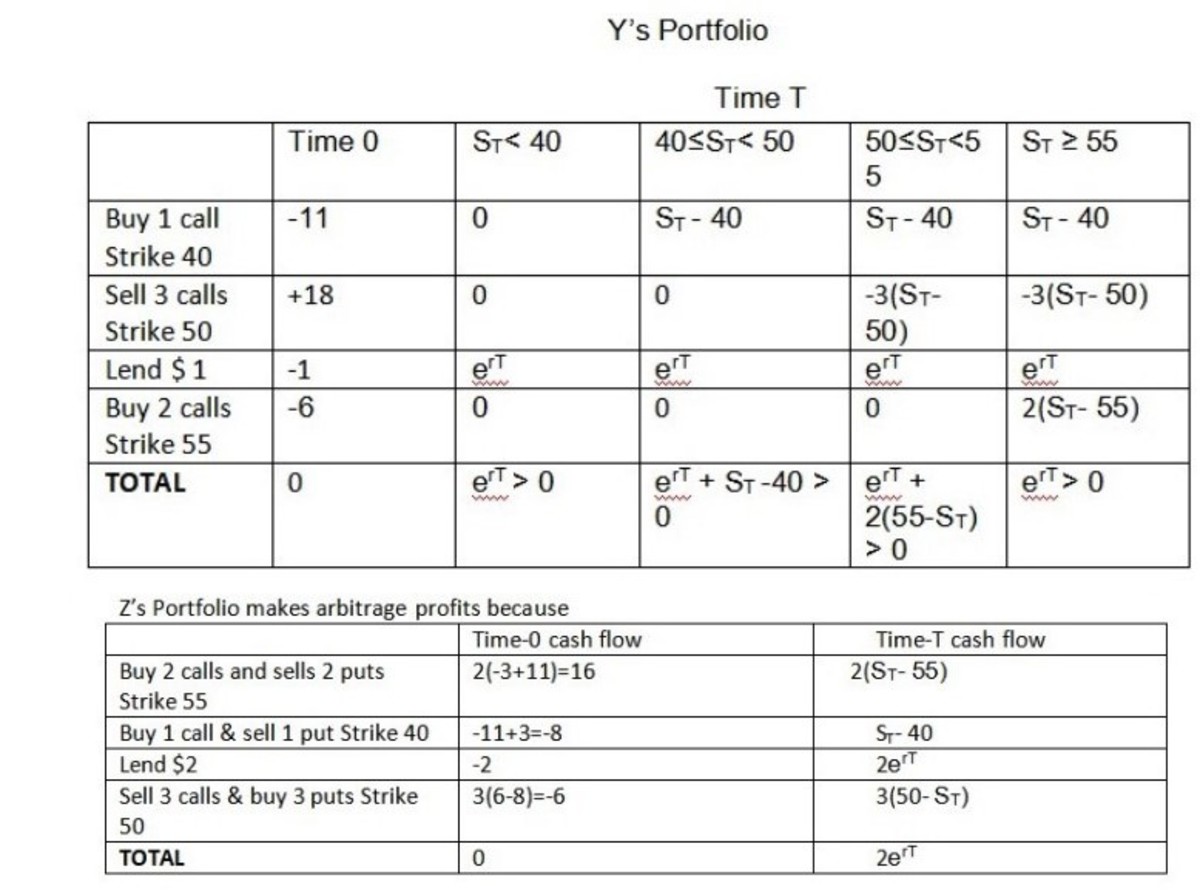

Y disagrees with X. She argues that one could use the following portfolio to obtain arbitrage profit: Long one call option with strike price 40; short three call options with strike price 50; lend $1; and long some calls with strike price 55.

Z also disagrees with X. He claims that the following portfolio, which is different from Y’s, can produce arbitrage profit: Long 2 calls and short 2 puts with strike price 55; long 1 call and short 1 put with strike price 40; lend $2; and short some calls and long the same number of puts with strike price 50.

Which of the following statements is true?

(A) Only X is correct.

(B) Only Y is correct.

(C) Only Z is correct.

(D) Both Y and Z are correct.

(E) None of them is correct.

This section requires Javascript.

You are seeing this because something didn't load right. We suggest you, (a) try

refreshing the page, (b) enabling javascript if it is disabled on your browser and,

finally, (c)

loading the

non-javascript version of this page

. We're sorry about the hassle.

Answer to this question is (D). Both Y and Z are correct. Because Y's portfolio and Z's portfolio both yields arbitrage profits. Have a look at below tables to understand how does Y's portfolio and Z's portfolio yield arbitrage profits,