Gold is more expensive in future?

Quantitative Finance

Level

2

Why is the future price of gold higher than the spot price of gold?

Why is the future price of gold higher than the spot price of gold?

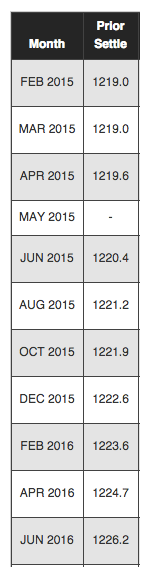

Image credit: CMEgroup

Gold in future is worth more

Storage and insurance costs

Interest rate

People pay for the privilege of holding physical gold

This section requires Javascript.

You are seeing this because something didn't load right. We suggest you, (a) try

refreshing the page, (b) enabling javascript if it is disabled on your browser and,

finally, (c)

loading the

non-javascript version of this page

. We're sorry about the hassle.

The future price of Gold is higher than the current spot price, for it includes fees of storage and delivery of the gold, also includes finance charges because of the delay payment.

Furthermore, the future price is determined based on the spot price.

The money market rate and supply/demand also affects the future price.

Generally, the rising interest rates adversely impact the Gold price.

I think everyone should read this .

According to it, whenever the dollar's real short-term interest rate is below 2%, gold rallies, and whenever the real short-term rate is above 2%, the price of gold falls.

Another rule of thumb is that gold moves eight times stronger than the difference between real interest rates and 2%.