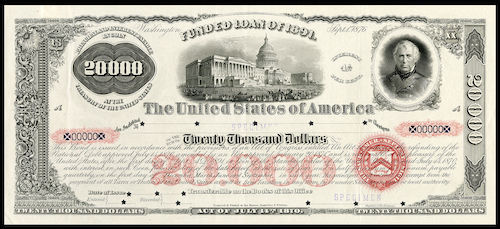

Have you seen $20,000?

You own a bond that will pay 7% per year for the next 10 years, on a principal of $20,000. If the prevailing discount rate is 10% throughout, what is the bond worth now?

You own a bond that will pay 7% per year for the next 10 years, on a principal of $20,000. If the prevailing discount rate is 10% throughout, what is the bond worth now?

The answer is 16313.26.

This section requires Javascript.

You are seeing this because something didn't load right. We suggest you, (a) try

refreshing the page, (b) enabling javascript if it is disabled on your browser and,

finally, (c)

loading the

non-javascript version of this page

. We're sorry about the hassle.

3 solutions

The price of a bond is determined by the present value of the coupon payments. Hence, it is equal to

( 1 . 1 ) 1 0 2 0 0 0 0 + i = 1 ∑ 1 0 ( 1 . 1 ) i 1 4 0 0 .

This gives us the value of 16313.26

Note that since the interest rate is lower than the discount rate, hence this bond trades at a discount.

Ok so there's a summation associated with it . Actually sir, a friend(who has taken commerce) has helped me out, no it was he who gave me the answer .

But your solution is clearer .

The present value of a coupon bond can be calculated as: PV= CPN * y 1 * (1- ( 1 + y ) N 1 ) + ( 1 + y ) N F V

- CPN is the Coupon the bond pays.

- y is the discount rate, also known as the Yield to Maturity.

- N is the number of periods.

- FV is the Future value.

Inserting the variables gives: PV= (0.07*20,000) * 0 . 1 1 * (1- ( 1 + 0 . 1 ) 1 0 1 ) + ( 1 + 0 . 1 ) 1 0 2 0 , 0 0 0 = 16313.26

I solved it using a spreadsheet: