Marginal Benefits in Brillianthood

Suppose you're the builder of luxury condos in the Brillianthood. You have a variable supply curve (as opposed to a fixed supply), that depends on the price you can charge for your condos. It's a linear function. If you can charge $100K per condo, you can build 25 condos. If you can charge $300K per condo, you can build 125 condos.

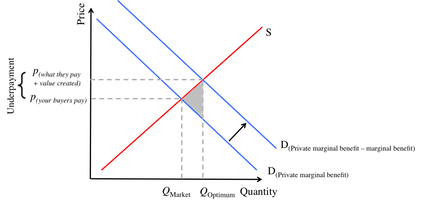

Unfortunately, you're the first into the market, and know that apartment prices are lower now than they will be after you build your condos. A real estate expert estimates that, at the present moment, demand will only allow you to get $200K per condo you build. But that after you build and sell your condos, demand will increase, and the market would be willing to pay $250K/condo. What's the marginal benefit you're relinquishing to the market?

This section requires Javascript.

You are seeing this because something didn't load right. We suggest you, (a) try

refreshing the page, (b) enabling javascript if it is disabled on your browser and,

finally, (c)

loading the

non-javascript version of this page

. We're sorry about the hassle.

Like the previous problems in the

Externalities

wiki, there is a deadweight loss created by "you" selling these condos at lower demand curve than the social marginal benefits. The deadweight loss is represented by the difference between those two demand curves, the grey triangle in the image to the right. In which case, you calculate the

area of the triangle

-

2

1

base

×

height

=

2

1

$

5

0

,

0

0

×

2

5

=

$

6

2

5

,

0

0

0

.

Like the previous problems in the

Externalities

wiki, there is a deadweight loss created by "you" selling these condos at lower demand curve than the social marginal benefits. The deadweight loss is represented by the difference between those two demand curves, the grey triangle in the image to the right. In which case, you calculate the

area of the triangle

-

2

1

base

×

height

=

2

1

$

5

0

,

0

0

×

2

5

=

$

6

2

5

,

0

0

0

.