Profiting from predictions

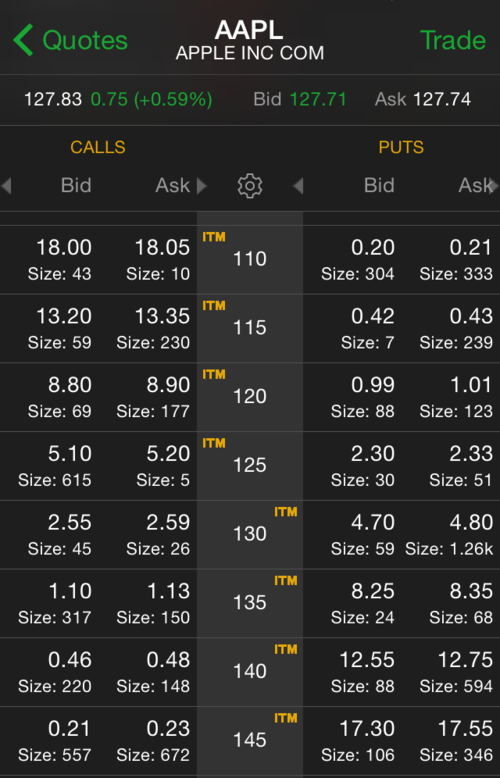

Sally expects that APPL stock will rise from its current price of $129.00 to $135.00 on March 20th.

Assuming that her prediction comes true

, which of the following option strategies would yield the most profit?

Sally expects that APPL stock will rise from its current price of $129.00 to $135.00 on March 20th.

Assuming that her prediction comes true

, which of the following option strategies would yield the most profit?

Note: No other corresponding trades are done. In particular, she does not hedge her delta exposure.

Ignore interest rate and transaction costs.

There are no dividends.

The image doesn't show the price of options when AAPL is at $129.00.

Image credit: Thinkorswim

This section requires Javascript.

You are seeing this because something didn't load right. We suggest you, (a) try

refreshing the page, (b) enabling javascript if it is disabled on your browser and,

finally, (c)

loading the

non-javascript version of this page

. We're sorry about the hassle.

The best trade is selling the $135 put.