Volatility drag - i

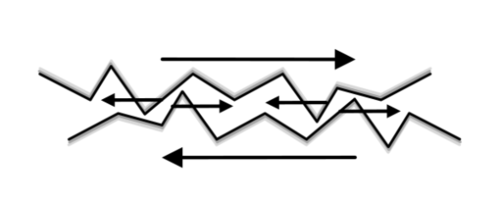

It seems that investments with a constant rate of return

end up with a different return than investments whose average rate of return is

. Might fluctuations in the return rate dissipate potential gains, like friction dissipates kinetic energy in physics?

It seems that investments with a constant rate of return

end up with a different return than investments whose average rate of return is

. Might fluctuations in the return rate dissipate potential gains, like friction dissipates kinetic energy in physics?

Which of the following explains what's going on?

This section requires Javascript.

You are seeing this because something didn't load right. We suggest you, (a) try

refreshing the page, (b) enabling javascript if it is disabled on your browser and,

finally, (c)

loading the

non-javascript version of this page

. We're sorry about the hassle.

0 solutions

No explanations have been posted yet. Check back later!