Having a better yield

An investor bought a bond, with a constant coupon rate, for $1000. The current yield of the bond is 10%. If the yield rises to 11%, what happens to the price?

An investor bought a bond, with a constant coupon rate, for $1000. The current yield of the bond is 10%. If the yield rises to 11%, what happens to the price?

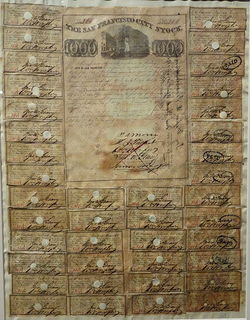

Image credit: Wikipedia Daderot

This section requires Javascript.

You are seeing this because something didn't load right. We suggest you, (a) try

refreshing the page, (b) enabling javascript if it is disabled on your browser and,

finally, (c)

loading the

non-javascript version of this page

. We're sorry about the hassle.

1 solution

As a note, there are multiple types of "yield". "Current yield" is defined as P C , which is why it allows us to make this simple calculation.

Let's reduce the question a bit. Assuming coupon rate is constant and equal to 0%, term equals 1 year, with a yield of 0.11, shouldn't the price be about 900?

Log in to reply

$909 is about $900. If coupon rate is 0%, then there is no yield and price = face value. Current yield is defined as in the solution.

There is not enough information provided in your question, to determine the information. Since you are modifying the question, you should be explicit and state what the modified / removed / constant parts are. For example, what is the current price of the bond? Furthermore, what are the current interest rates?

Finally, revise how to price a zero coupon bond . What are the parameters that are important? Are all of that values given in your problem?

Log in to reply

From your response, I deduced the "yield" in the original question meant current yield instead of YTM?

Log in to reply

@Yang Yang – Look at the question again. It does state current yield of 10% , and not just yield .

In general, the term yield is ambiguous, and you will have to learn which one is being referred to. Sometimes, it will be assumed from the context, especially to reduce words.

Shouldn't you specify the bond is a perpetuity?

Log in to reply

In this case, the length to expiration doesn't matter.

Log in to reply

Sorry. I missed current. Apparently I am not alone. In fact, I am not sure the concept of current yeild is very useful for pedagogical purposes.

From the question, $1000 isn't the face value, but the market value, already taking the 10% coupon into consideration.

Let's see if I get it right... The "current yield">10% doesn't mean that you are earning more than the 10% of the face value in every coupon: it just means that at the market price of the bond it is more profitable (i.e. 11%) than the 10% of its rate when it was released. Am I right?

Log in to reply

Not quite. You don't know what the face value of the coupon is. Actually the coupon rate is independent of the analysis.

As an example, take the simplistic case where the bond returns the principal + coupon at the end of 1 year.

The bond is worth $1000 and has a 10% yield, which means it will return $1100 at the end of the year.

The original bond could have been in any of the following scenarios:

- created with a principal of $900 and the coupon yielded $200, so the coupon rate is

≈

2

2

%

.

- created with a principal of $1000 and the coupon yielded $100, so the coupon rate is

1

0

%

.

- created with a principal of $1050 and the coupon yielded $50, so the coupon rate is

≈

4

.

8

%

.

Current yield Y is given by: Y = P C , where C and P are the coupon rate and the bond price respectively. We note that C is fixed at 1 0 % of the face value F = $ 1 , 0 0 0 or $ 1 0 0 .

Therefore the new price is given by:

P ′ = Y ′ C = 0 . 1 1 $ 1 0 0 = $ 9 0 9 . 0 9