Trading Puts on Facebook

FB's current stock price is $75.89. A broker's market for the put option on the $80 strike expiring in 2 days is $3.75 bid at $4.00. Assuming no execution risk, what trade do you want to execute?

Assume that the risk-free interest rate is 0%, FB does not issue dividends, and that there are no transaction costs.

This section requires Javascript.

You are seeing this because something didn't load right. We suggest you, (a) try

refreshing the page, (b) enabling javascript if it is disabled on your browser and,

finally, (c)

loading the

non-javascript version of this page

. We're sorry about the hassle.

1 solution

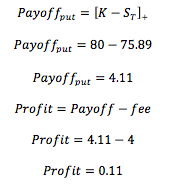

Right. If we were able to buy the stock for $75.89, then we can guarantee a $0.11 profit, regardless of what happens.

Of course, if this trade were to be executed in the market for significant size, I would the expect the underlying price to rise as this trade is being hedged.

It wasn't specified whether the option was European or American, hence we don't know if we can exercise it immediately...

Log in to reply

It doesn't matter, you do not need to exercise it now.

What you do is buy the put for $4, and buy the stock for $75.89 (for an initial outlay of $79.89), and then wait till expiration (in 2 days) to sell it for $80. Ignoring transaction + interest costs, you pocket $0.11.

There are several reasons why such a scenario could arise:

1. Facebook suddenly experienced a severe downtick, making this an attractive price to trade.

2. Broker had live customer orders that were to be executed at the price.

Log in to reply

But it also depends on the risk free rate. It is not a likely scenario, but if I can get more than $0.11 on $79.89 investment in 2 days risk-free, then it would not worth buying the option.

Log in to reply

@Ákos Bakonyi – Thanks. I've added that the risk free interest rate is 0%, and that there are no transaction costs.

Is that a common way to describe a bid-ask spread? "$3.75 bid at $4.00" means that you can sell the put to the market-maker for 3.75 and buy it from him for $4.00 ?

Log in to reply

That's common terminology (but could depend on location). It is also referred to as "$3.75 bid ask $4.00".

It arose from asking "What is your bid? What is your ask at?", and "bid at" is quicker and easier to say than "bid ask", because of the peasky "k" sound.

Im sorry but I disagree. To guarantee a profit we need to hedge our synthetic position in the stock. We need to know the ask not just the spot. Not enough info is provided.

Log in to reply

You are told "FB's current stock price is $75.89".

You want to buy the option and the stock.

disagree. Need info on dividend and interest rate.

Log in to reply

Interest rate - As stated in the question, assume it is 0%.

Dividend - Good point, let me add that in. Note that having a dividend in the next 2 days will not affect the answer. Why then must we be aware of dividends?

Disagree as 2 days to expire stock can go up any where and will washout $4 paid

Log in to reply

Note that you can lock in an immediate profit by buying the option at $4.00 and buying the stock at $75.89 (assuming no execution risk). You are not required to only hold the options.

We definitely need info on stock's Vol if we want to price correctly, cuz a lot could happen in two days, specially that we suppose here thay the option is European

Log in to reply

By buying the puts and the stock, you can lock in a gain of $0.11. As the owner of the puts, you determine if/when you want to exercise them, so there is no risk of early exercise.

In this moment the put option is ITM, so its intrinsic value its positive and covers the fee of entering in to the contract, so we will take some profit.